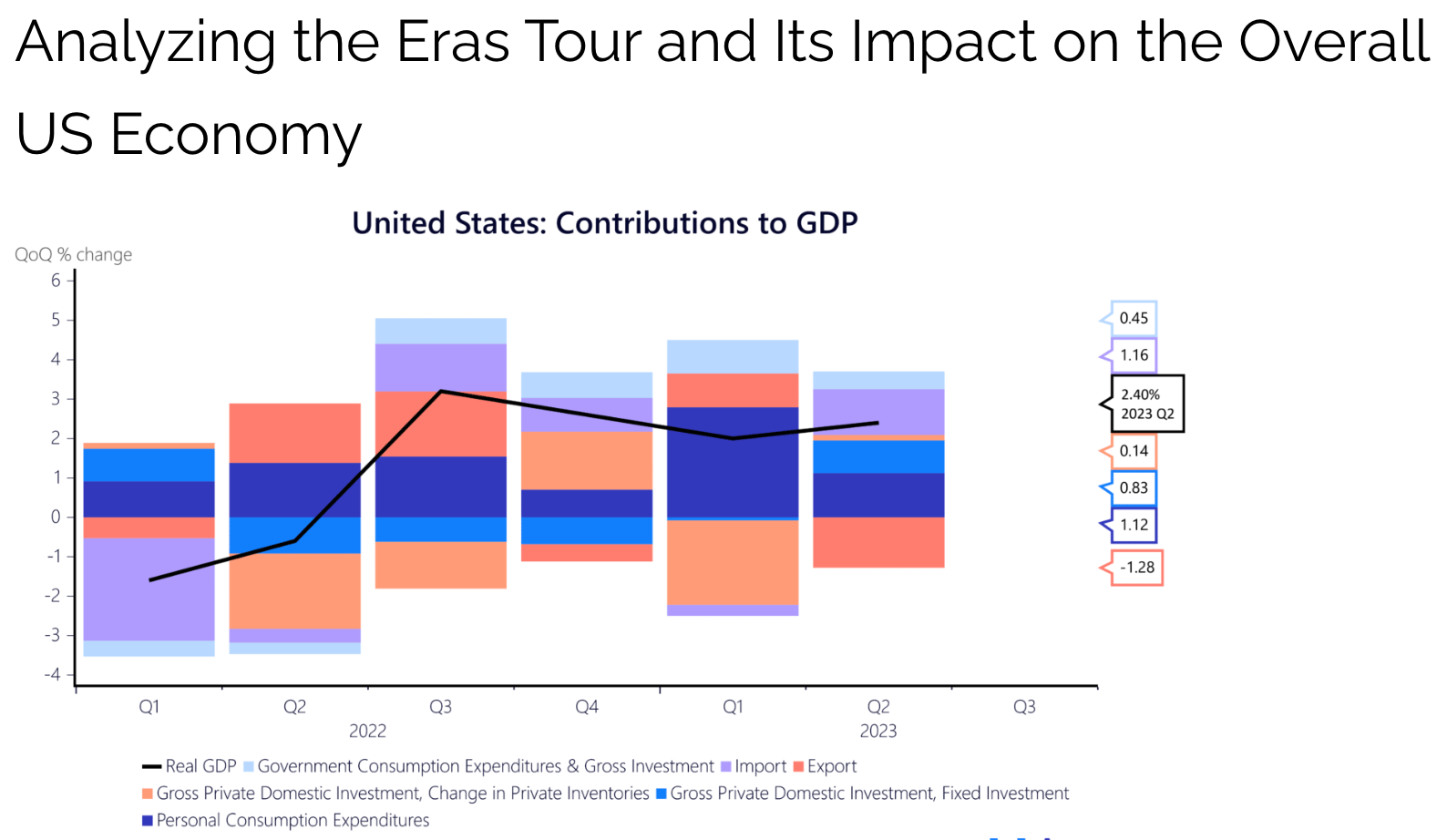

In 2023, Taylor Swift’s Eras Tour did something pulled off what most governments only pretend to do: it boosted GDP.

$4.3 billion into the U.S. economy

Nearly £1 billion into the UK.

Her impact was so large, UK Parliament documented it in Hansard.

And the numbers stack up: 152 stadium shows in two years across five continents. The first tour ever to smash $2 billion in revenue. An average of $1,300 squeezed out of every fan once you factor in tickets, vinyl, merch, streaming, even a concert film. It’s industrial-scale capitalism dressed up as a night out.

But behind the glitter, friendship bracelets and wall-to-wall TikTok coverage was something else: a business strategy so sharp it turned a cultural movement into a monopoly.

Taylor Swift isn’t just the soundtrack to your teenage heartbreak. She’s the clearest case study in how to raise, scale and dominate a market until there’s nothing left for anyone else.

Today’s setlist:

Locking up scarce assets before rivals

Capturing wallet share, not just market share

Using scarcity and FOMO to drive decisions

Building loyalty that defends your valuation

From Nashville to world domination

Taylor Swift didn’t just stumble into $1.6 billion. It’s been two decades of pivots, power plays and the sort of corporate ruthlessness you’d expect from an oil baron, not a pop star.

She started out as a Nashville teenager writing confessional country songs - basically a diary set to guitar. The audience was small, but her storytelling was sharp. It also helped that her parents weren’t exactly broke. They moved the family to Tennessee to support her career. So yes, talent plus trust fund. A potent combo.

Then came Red. It’s my favourite - which, as someone my age, probably says more about me than it does about Taylor. It also marked her first big pivot: stepping out of country and into full pop dominance. Along the way, she pulled one of the shrewdest moves in music history: buying back her masters. What started as a contract battle became one of the savviest monetisation plays in music. She re-released the songs, and fans more-than-gladly paid for them a second time. Genius.

The pandemic hits, live music dies, and what does she do?

Drops Folklore and Evermore. Indie-folk albums for people who suddenly started baking sourdough and googling “how to chop wood”. They landed perfectly. And by that point, fans had grown up with her. From soundtracking your teenage heartbreak to blasting out of the car speakers on the school run, her tracklist spans the whole arc - puberty to mid-life crisis.

And then, the Eras Tour: the boss level. A mega-tour that stitched together every phase of her career into one $2B cash printer. It’s nostalgia, reinvention and monopoly power rolled into sequins. And crucially, she pulled it off without dilution - every era fuelled by reinvestment, not giving away equity. Which is why she sits comfortably on a $1.6B net worth today, probably plotting how to trademark your childhood memories.

How to scale like Swift

We’ve covered her career moves already. Now it’s time to focus on the Eras Tour - because no one should ignore numbers like these.

Here’s what Taylor teaches you, an SME owner:

A) Lock up scarce assets

Taylor locked down SoFi Stadium for six nights straight, effectively freezing every other major act out of LA’s biggest venue. That’s how you turn scheduling into market control.

Founders can run the same play by securing capital and partnerships before anyone else gets a look in. Lock in credit lines, anchor investors or long-term supply contracts early, and you’ve denied rivals access to the very resources they need to compete.

Tesla also proved this works. Years before EV demand exploded, Musk struck exclusive battery supply deals with Panasonic and poured billions into the Nevada Gigafactory. By the time competitors realised how critical batteries would be, Tesla had already secured the infrastructure that powered its dominance.

Swift moves far beyond ticket sales. Fans buy multiple vinyl versions, exclusive merch, streaming subscriptions and even a cinema release of the very tour they already attended - because apparently seeing it live once isn’t enough.

The typical Swiftie (yes, I know the word) ends up funnelling their entire entertainment budget her way. That’s wallet share in action - and it’s a play SMEs can use too.

Taylor’s not the only one at it. Glossier started life as Into The Gloss, a beauty blog. From there it became a DTC product line, then expanded into events, retail stores and community-driven activations. Each layer kept the same fans spending more in the same ecosystem.

Apple perfected the model in tech. The iPod locked people into iTunes. That fed into the App Store, which locked them into iPhones, which tied them to subscriptions and services. Each product reinforced the next until Apple controlled the customer’s digital life.

Be honest, you’re probably reading this on your iPhone - AirPods blasting Taylor, Apple Watch nagging you to stand up and a MacBook waiting its turn. See my point?

What I’m saying is: it’s not about chasing a bigger crowd, it’s about capturing more value from the crowd you already have. Just remember, don’t spread yourself too thin until your main product is paying the rent on its own. Taylor only expanded once each “era” had already proven itself.

C) Create scarcity and FOMO

Taylor releases everything with a clock attached. Presale codes expire. Vinyl editions disappear. Merch drops vanish in minutes. Fans know the rule: hesitate and you miss out, so they buy first and rationalise later. I even know someone who once paid £1,800 for a concert ticket. Madness - but that’s the grip of engineered scarcity.

It also works in fundraising. Scarcity forces action. Take the case of the ex-OpenAI alumni - they pulled billions almost overnight before their products were public. This was because nobody wanted to be the investor that missed the ‘next AI rocket ship’.

Scarcity doesn’t just raise demand - it accelerates decisions. And when you control the clock, you control the capital.

D) Build loyalty strong enough to defend your pricing

When ticket prices pushed past $300, most artists would’ve been ripped apart by headlines and fans. Taylor wasn’t. The anger was directed squarely at Ticketmaster. Why? Because years of carefully built trust gave her a narrative shield. Fans believed she was the victim of a broken system, not the one cashing in. That shield is priceless: it let her keep margins high without taking the blame.

The same thing happened with her “Taylor’s Version” albums. On the surface, she asked people to buy the same product twice. But she positioned it differently: not as a cash grab, but as a fight to reclaim her masters from the label that owned them.

A commenter on my LinkedIn post is just as impressed as I am:

Fans weren’t re-buying the albums for the music. They were supporting her taking back control. She turned a rights dispute into a cause, and what should’ve cost her money ended up making her more.

Patagonia pulled the same lever in retail. When Yvon Chouinard transferred ownership of the company to a trust dedicated to fighting climate change, stakeholders didn’t push back on how the decision would affect profits. They celebrated it. The clarity of the mission - protect the planet - was so strong that people defended the economics instead of questioning them.

Your takeaway? Loyalty is most powerful when it’s tied to meaning, not discounts. If your mission resonates deeply, your backers will rationalise higher prices, tougher terms or bigger valuations on your behalf. Instead of fighting you, they’ll fight for you.

Since you asked…

Here’s what I think: Equity makes sense for projects that need patient money with no quick payoff. But that’s not Taylor’s style. She didn’t take on outside shareholders; she reinvested and kept control.

If you want to keep control of your business, use debt. Lenders will give you rules - hit your targets, don’t empty the account - but that’s temporary. Equity is permanent. Once you sell it, it’s gone. Taylor proved you don’t need to give ownership away to scale.

The rule holds: raise to own the stage, not share it. That’s the whole point of my company, FundOnion - helping SMEs secure capital early without handing away the upside.

Let’s change the record for a sec

Let’s give Taylor a breather - she clearly doesn’t need me to boost her streams. If you’re curious about my music taste beyond Red, a lot of my Spotify Wrapped last year consisted of Ryan (not Bryan) Adams.

He’s never going to headline Wembley six nights in a row, but that’s not the point. His songs hit differently: intimate and full of emotional depth.

That’s what I want from music.

TL:DR

Swiftly returning to business. When you strip away the sparkle, here’s what you get:

Get capital, contracts or commitments before rivals wake up.

Expand how much value you capture from each investor/customer.

Set deadlines, cap allocations and make hesitation expensive.

Build a loyal fanbase that justify your valuation for you.

Okay, final chorus

Taylor Swift is a capitalist. She didn’t get to $1.6B by giving anyone else a chance. She took it all: venues, wallets, narratives. I reckon she’ll run for president soon - and win.

If you’re raising, don’t wait for opening night - make your play while the seats are still empty. That’s why I started a platform that helps founders get their funding locked in before the stage lights up (it’s called FundOnion).

Hit reply to start the conversation - just stick your favourite Taylor track in the subject line so I know you’re serious.

Till next time,

James