Let’s start with a quick game…

Two truths and a lie, Tesla edition:

Tesla is now valued at $1.4 trillion

Tesla has been profitable since the beginning

Tesla was on the brink of collapse in its first decade

If you picked number two as the lie, gold star. (Glad to see you’ve been keeping up with the headlines).

Tesla wasn’t built on profit. It was built on brinkmanship. The company spent much of its early life surviving by the skin of its teeth - and its first car, the Roadster, nearly finished it off entirely.

Production was delayed for years, every unit lost money and in 2009 almost 70% of them had to be recalled over a defect that could cause drivers to lose control. Not exactly the PR you want for “the future of transport”.

So, we’ve killed off point two and proved point three. Which leaves us with point one: Tesla really is worth $1.4 trillion today.

But the question is, how do you get from near-bankruptcy and a defective first car… to the world’s richest automaker?

One word: Musk.

The man who kept Tesla alive with his own chequebook. The board handed him $56B last year. Not bad, considering it’s his side hustle…

Now, you might not be chasing a trillion-dollar valuation, but there are lessons for SMEs raising capital in this issue, including:

a) Why some companies keep attracting investors long after others fold

b) How to balance personal vs external capital - and use leverage without losing control

c) The risks (and rewards) of building a business around one individual

d) How to build investor confidence before your profits arrive

From the brink to billions

Tesla was founded in 2003 by two engineers - Martin Eberhard and Marc Tarpenning - who had a prototype and a belief that electric cars could be cool. What they didn’t have was money.

By early 2004, Tesla needed capital to turn their idea into a company. Enter Elon Musk, fresh off his PayPal exit - the company he’d helped build and sell to eBay for $1.5B. At PayPal, Musk mastered the art of speed and story: scaling fast, attracting investors with vision and turning early losses into market dominance.

He brought that same approach to Tesla. He led Tesla’s first funding round with a $6.5M cheque, becoming chairman. At that stage, he wasn’t running the company, he was the investor who bought them time.

That time didn’t last long, though. The Roadster turned into a financial black hole. Development costs ballooned from an estimated $25M to well over $100M. Suppliers failed, production targets slipped, bottlenecks multiplied. Tesla was hemorrhaging cash at this point.

By 2007, Tesla had raised over $100M in private financing, but it wasn’t enough. Losses piled up. That year, Eberhard was pushed out, Musk stepped in more aggressively and tension inside the company mirrored the financial chaos outside it.

Then came 2008. If Tesla was already wobbling, the global financial crisis was a knockout punch. Credit dried up, investors fled, and Tesla - still losing money on every car - was left with only weeks of cash.

To keep Tesla alive, Musk did what most investors would never dare: he doubled down. He’d already poured in $70M of his own fortune, but he went further - taking over as CEO, slashing staff, delaying projects and hustling a last-minute $40M raise just to make payroll at the end of 2008.

That lifeline bought Tesla enough time to land outside help. In 2009, Daimler invested $50M for a 10% stake. Later, the U.S. Department of Energy approved a $465M loan to scale production. Without those deals - and Musk personally underwriting the company - Tesla would have folded.

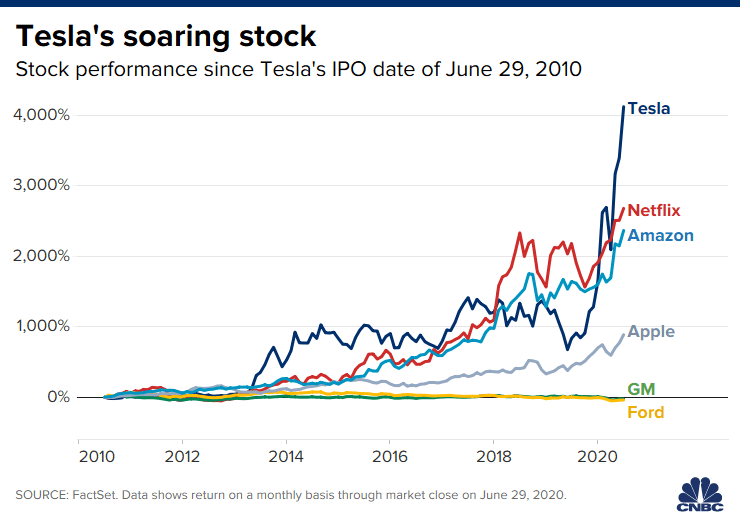

By 2010, Tesla limped onto the public markets with its IPO. It raised just over $200M - hardly a war chest, but enough for survival.

It wasn’t until the mid-2010s, with the launch of the Model S and the explosion of investor interest in EVs, that Tesla’s finances finally moved out of crisis mode.

Today: Tesla spits out billions in free cash flow. But that’s not what’s driving a $1.4T valuation. Wall Street isn’t paying for EVs on the road today - it’s paying for the stories Musk sells about tomorrow: self-driving fleets, humanoid robots, global energy dominance, maybe even a Mars colony if he has the time (imagine if that happens, I'm off)

Put simply, Tesla didn’t win because it built the best cars. It won because Musk convinced the world he’d build the future. The factories, the tech, the talent - all replaceable. The vision is the part you can’t copy. Musk sells possibility better than anyone on the planet, even when the product’s still half-imaginary.

I recently posted on LinkedIn about Musk. Someone replied that credibility is basically the internet’s new currency, and they’re right. It’s what Musk trades in, and he’s made billions doing it.

Which is why, in 2024, the board signed off the largest pay package in corporate history: $56B. Worth repeating.

Not for R&D.

Not for expansion.

Just to keep Musk engaged - instead of wandering off to his next circus act (see: Twitter Takeover, feuding with Trump, launching a political party).

I like Musk. There, I said it

Remove Musk and Tesla is, simply, an overpriced car company. Keep him in and it’s a trillion-dollar story about the future. Investors can’t resist that.

He throws out ideas that sound insane - robotaxis, humanoid helpers, Mars colonies, the lot - then somehow convinces capital to follow. It’s either genius or madness, and on any given day it’s both.

He’s also messy. The public feuds, the political stunts, the Twitter drama - none of it would fly from anyone else. Yet with Musk, it fuels his EV business (ironically). Investors grumble, then double down.

That’s the gamble: the same man who creates the risk is the one creating the upside. If he’s obsessed, the stock climbs. If he walks away, the value goes with him.

We’ve seen it all before. When Steve Jos resigned in 2011, Apple’s stock shed 3% in a day - billions gone in a puff of smoke - and this was after the iPhone had already taken over the world.

What Tesla teaches us

The lesson isn’t “be like Tesla”. It’s “don’t die like Tesla almost did”. Here’s how you stack the odds in your favour:

A) Borrow like a pessimist

A simple rule: don’t lever more than 30-35% of your net worth. Why? Because if you can only afford to buy something once, you can’t afford it. At 30%, you could (in theory) buy it twice and still have a safety net. It’s the difference between strategic risk and financial self-sabotage.

Musk famously mortgaged everything for Tesla and SpaceX… and nearly lost both. For every Elon, there are hundreds of founders who bet the house and never got the Hollywood ending. Be ambitious, but don’t get carried away.

B) Use capital to scale, not survive

Raising money is supposed to fuel the mission, not become the mission. Too many founders treat ‘closing a round’ like hitting product-market fit. Musk drip-fed Tesla from his own wallet until he couldn’t. Use capital to accelerate your growth, not to paper over a business model that isn’t working.

C) Ditch the shopping list pitch

“£200k for marketing, £100k for staff, £50k for a new office…” Nobody cares. That’s not a pitch, it’s a receipt. Investors want to know how today’s £1m becomes tomorrow’s £25m. Tesla didn’t raise on line items; it raised on “we’ll own the future of cars”. Lead with outcomes and valuation growth, not a budget breakdown that makes you sound like you’re applying for a small business grant.

D) Beware the ‘raise more’ trap

Overfunding feels safe - more runway, more breathing room, more buzz. But it usually does the opposite. Every extra pound raised adds another opinion to manage, another report to file, another person asking for updates. The best capital is the kind that keeps you nimble rather than the kind that keeps you busy. I’d suggest raising the smallest amount that gets you to your next defensible milestone.

E) Obsess over shareholder value

Investors don’t care about your product. They don’t care about your customers. They care about one thing: whether their shares are worth more tomorrow than they are today. Everything you do has to ladder up to that story. If you can’t make the case for compounding shareholder value, you don’t have an investment case - you have a hobby.

F) Deploy capital to buy time, not hoard it to feel safe

Money in the bank is nice; money that pulls milestones forward is better. Tesla survived by constantly buying itself time - enough to limp to the next round, the next loan, the next investor.

It’s the oldest rule in business: you have to spend money to make money. I don’t condone gambling, but business isn’t far off - the trick is knowing when you’re placing a calculated bet, and when you’re just pushing your luck.

Hoarding = cautious.

Progress = bankable.

Of course, you ~probably~ don’t have the track record (or net worth) of Elon Musk. And that’s fine. You don’t need to bankroll your own business with PayPal money to apply these lessons.

But if you’re worried your short trading history makes it harder to apply the above lessons, I’ve broken down how to get around that in this article.

TL;DR:

A) Investors didn’t back Tesla because it built great cars. They bought into Musk’s vision and the belief he could drag the future into the present.

B) Musk is both Tesla’s biggest advantage and its biggest liability. The company’s value rises or falls on whether he stays interested.

C) Raising capital should boost what you’re already building, not become the whole mission. Money is there to accelerate momentum, not define it.

D) Avoid over-leveraging yourself. Keeping debt below 30-35% of your net worth means you can survive a downturn and fight another day.

E) When pitching, focus on outcomes, not budgets. Investors want to see how £1 today becomes £5 tomorrow.

F) And no matter how visionary your product seems, investors only care about one thing in the end: how it increases shareholder value.

I don’t talk about this much

But the biggest influence on me - and how I approach work and life - was my dad. His life was cut short, which meant I had to start reflecting earlier than most. The lessons I took from him guide how I work today:

Question the status quo

Stay driven when things get tough

Stand firm when others push back

Build a business that aligns with the life you want to live

That mindset has shaped every decision I’ve made since founding FundOnion.

It’s easy to get wrapped up in learning from the big names: the Musks, the Bezoses, the Bransons. But sometimes the most useful lessons come from much closer to home.

One for the road…

Musk raised billions selling visions of Mars. You’re raising thousands to build something real right here on Earth. Different scale, same challenge: convincing people to believe.

If you want to know what actually makes you eligible for funding, I’ve spelt it out here - and if you’ve got questions, just hit reply.

Till next time,

James