Few startups have scaled faster than Blank Street. They took one of the world’s most crowded markets and still found a gap.

$113.8M in three years. A half-billion valuation. And yet, ask anyone if the coffee is good and the answer’s a shrug.

Exactly the point. Investors didn’t care if it tasted like citrus or like burnt toast. They cared that every store could deliver the same cup, at the same speed, thousands of times a day.

Blank Street rose very quickly:

The first $7M proved the model: 500 sq ft shops, ninety seconds from door to door

Another $25M scaled it: Swiss machines churning out 90 cups an hour, identical every time

$35M more turned coffee into routine: $18-a-week subscriptions that took customers from two visits a week to six. (Ring a bell? Pret’s version landed mid-pandemic)

And by 2023, $46.8M turned routine into culture: pop-ups with queues, a viral Sabrina Carpenter partnership, stores designed to be Instagrammed with every visit

Again, it was never about sourcing the best quality beans. It was about building a system that investors could view as a repeatable cash engine.

Want to know how this case study can help the average SME? Settle in, sip your overpriced latte, pretend you can taste the difference and read on. (No shade, I’m also guilty)

Today, I’m covering:

a) Why Blank Street’s fundraising worked at each stage

b) How they designed efficiency into the model from day one

c) What founders can apply (and what only works at scale)

d) Why investors backed the strategy, not the coffee

This is what operational genius looks like

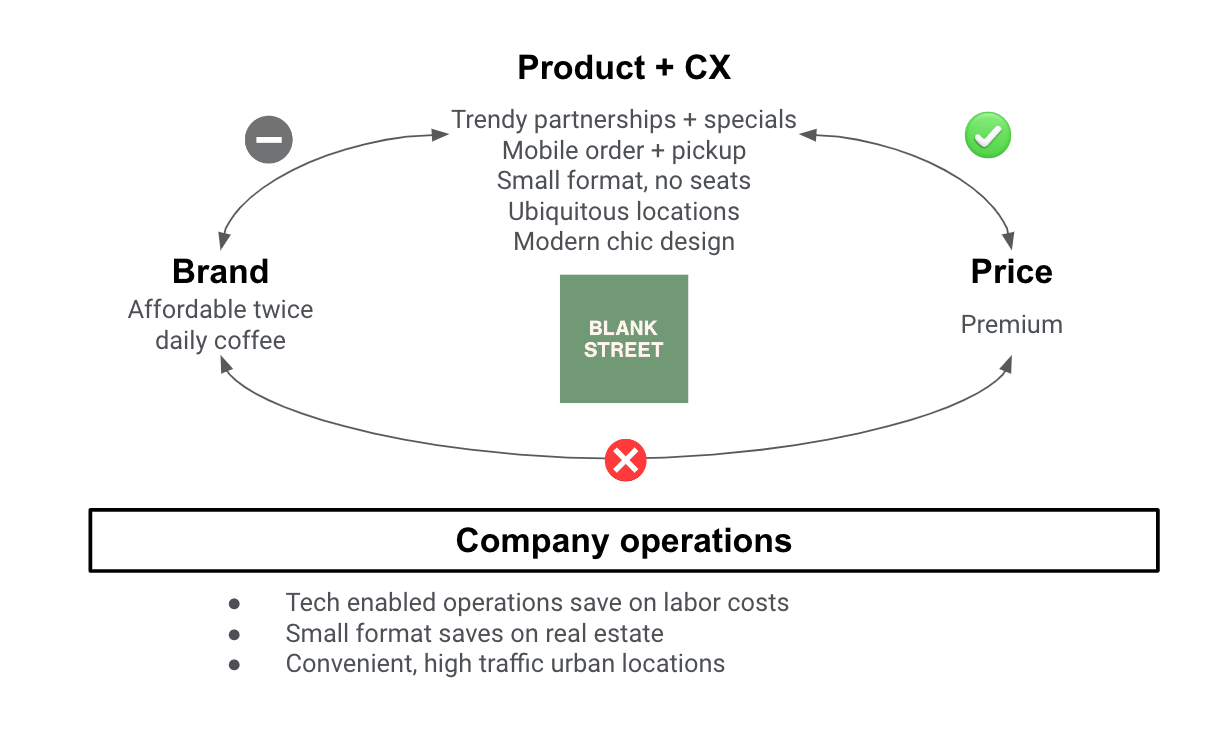

Okay, we’ve already established the lattes weren’t winning awards. Instead of obsessing over whether the beans had “notes of citrus” or “hints of smoke,” Blank Street zoomed in on something much more bankable: engineering the experience. And honestly? Clever move.

What they built was less about flavour and more about frictionless routine. Walk in, order, get out in ninety seconds flat.

No faffing, no waiting for an overworked barista to perfect their milk froth. Just a predictable pit stop you could fit between the Tube and your morning meeting.

Customers didn’t need the best cup of their life; they needed a quick caffeine hit that tasted acceptable enough not to complain about.

That’s what embedded Blank Street into daily schedules. And once customers were hooked, investors paid attention.

Think about it:

A Starbucks barista can serve, let’s say, 40-50 drinks an hour at peak. Blank Street’s machines? Ninety an hour, all identical. Nearly double the throughput, with none of the training cost, churn risk or quality slip-ups that chew into margins.

Staff costs are one of the biggest line items in hospitality. Strip out “artisan skill” and replace it with automation, and suddenly labour is a fixed cost: predictable, repeatable, scalable. Investors love that. Gross margin becomes a function of real estate, not human error. Looks great on a P&L - and even better in a pitch deck.

And consistency does something else: it builds investor confidence. This is how it plays out:

Customers knew exactly what they were getting → so they slotted Blank Street into their routine without thinking twice.

Predictable demand meant expansion was easier → new sites could open without testing menus or formats.

Consistency across locations → a cut-and-paste model that carried from Hackney to Harlem, Shoreditch to the Upper East Side.

Visible demand validated the model → queues outside the pocket stores doubled as free PR and proof the system could repeat.

It’s the same logic McDonald’s built an empire on. Nobody thinks the Big Mac is gourmet. But investors knew they could sell it anywhere in the world and it would taste (and cost) the same. Blank Street just applied that to coffee culture and dressed it up in millennial branding.

And the branding worked. Limited-edition collabs with OnlyNY turned coffee into lifestyle merch. Stores were designed to be photographed as much as visited. The photos looked great - but then again, everything on Instagram does. You pretended you loved it, when really it was nothing to write home about.

That’s why Blank Street commands a $500M valuation: the product of industrial-strength systems. Stores that run lean. Output that never wavers. Loyalty baked into the routine. And branding sharp enough to turn consistency into culture investors could underwrite.

A reply on my recent LinkedIn post capture the essence:

In other words, nobody cares how “authentic” your product is if it wastes their time. In 2025, speed and consistency can be the brand.

Quick word of warning

If you’re already sketching your pitch deck with Blank Street-level ambition, slow down a second. Here are a few things worth keeping in mind before you sprint to the nearest investor.

⚠️ Use debt when it amplifies growth, not when it funds survival. In 2021, Blank Street was still proving its model, so they started with equity to give themselves breathing room. Once the system was stable, debt helped them scale faster without more dilution. The timing made the difference - debt is powerful when your cash flow supports it.

⚠️ Who funds you is as important as how much they give. Blank Street’s edge was the networks and credibility behind them. Well-connected backers generate press, open doors and smooth the path to later rounds. That halo effect is something no bank term sheet delivers.

⚠️ Speed only counts when extra capital actually compounds. Blank Street pulled in round after round because every dollar turned into visible growth. For SMEs, it’s not about opening 50 sites overnight, but proving that each injection of money multiplies results, not just buys time.

I share case studies and insights like this every week on LinkedIn - from fundraising strategy to investor psychology. Worth following if you’re raising soon.

The strategy you can follow

Warnings over. Here’s what you can take from Blank Street:

A) Raise to hit a milestone that forces belief

Blank Street’s $7M seed was enough to prove the model at scale and make the next round a no-brainer. For SMEs, that means raising to reach a point nobody can argue with: a second site, £1M in recurring revenue, a waitlist you can’t clear. The cheque isn’t for “keeping the lights on”, it’s for making your progress too obvious to ignore.

B) Pick investors who buy you more than money

Blank Street’s backers made later rounds inevitable because they added credibility, opened doors and created buzz that money alone can’t buy. That’s the test for founders too: will this investor make it easier to hire, sell or raise again? If the answer’s no, all you’ve got is a silent partner with an expensive equity stake.

If you didn’t already know, you can compare potential investors directly on FundOnion and see who’s the best fit for your business.

C) Take on debt when your cash flow can carry it

Blank Street waited until their model worked before borrowing. That’s the difference. If you take on debt too early, the repayments run the business - not you. Wait until cash flow is steady, and debt becomes a tool for growth instead of a trap.

D) Don’t mistake celebrity for strategy

Blank Street’s collabs worked because the brand already had momentum. For most SMEs, you’re not signing A-listers - and if you’re spending half your week chasing Z-list influencers for a shout-out, it might be worth asking if that time’s better spent fixing your margins or keeping customers coming back. Get the fundamentals right first. Then, if you still want an influencer, at least they’ll be haloing something worth the hype.

E) Spend like the clock is ticking

Every raise starts a timer. Investors expect results, not experiments. Blank Street used their capital to double down on one proven model and scale it fast. Flow did the opposite - spreading theirs too thin on kombucha taps, co-working spaces and “community vibes.” Capital doesn’t buy safety; it buys pressure. Spend it fast, but spend it well.

F) Make your growth tangible and trackable

Blank Street earned investor confidence because the growth was tangible: new stores, new queues, new subs. Visible momentum silences doubts. Slow, invisible “trust me, it’s working” growth does the opposite - it kills confidence faster than a bad quarter. If capital goes in, everyone should feel it, not just read about it in a deck.

In the end, funding is less about capital itself and more about what it validates.

Indulge me for a minute

This is the bit where I drift from fundraising into life philosophy (briefly, I promise). The other day I was asked if I had any regrets in life. My answer was no, because if you learn from something, it’s not wasted. But if I absolutely had to choose, it might (ironically) be going to university.

The value feels different now. You don’t need a £50k degree to access knowledge anymore - you can download MIT lecture notes for free, binge Stanford lectures on YouTube or take notes from entrepreneurs showing their work online for free. The bottleneck is no longer access to information, it’s knowing what to do with it.

That said, the more I think about it, the less I regret it. Those years probably taught me a lot that I don’t register day to day - friendships, resilience, learning how to juggle deadlines (and hangovers).

What about you? Did you go? Do you regret it? And in 2025, do you reckon university is still a rite of passage - or just three years of getting drunk and dodging adulthood?

TL;DR:

Back to adulthood. Here’s the Blank Street recap:

A) Speed is a business model. $113.8M in three years didn’t buy them better beans - it bought them efficiency, scale and habit-forming convenience.

B) Rituals drive retention. By engineering coffee into customers’ daily routines, they created loyalty without needing a loyalty scheme.

C) Systems beat talent. Automation turned staff and rent into fixed, scalable costs - and that predictability made investors comfortable.

D) Consistency builds confidence. Investors didn’t back the product; they backed the system that could replicate it anywhere.

E) Equity buys freedom. Raising early allowed Blank Street to test fast and fail quietly before proving the numbers.

F) Culture multiplies value. The brand made coffee feel like a lifestyle, and investors always pay a premium for brands that sell identity.

Forget the latte art, show me the repeatable model

At the end of the day, good products win customers. Great systems win funding. And funding, like caffeine, is what keeps the whole thing running.

The Blank Street story is proof that investors will always chase the engine that prints returns, not the craft behind the counter (sad, but that’s the harsh reality).

If you want to see which investors could back your system, you can compare them at FundOnion.

Till next time,

James